Creating a new way for people to pay with NAB

Client

National Australia Bank

Services

Design Research, Strategic Design, Product Design, Customer Experience

Industry

Financial Services

Year

2020 – 2022

Impact

Faced with a shift in customer attitudes towards credit and the rise of Buy Now Pay Later (BNPL) Fintechs, NAB needed to make a move to meet evolving customer needs. With Symplicit leading end-to-end design activities, NAB launched NAB Now Pay Later, which is live to NAB’s three million+ customer base.

Value

NAB Now Pay Later delivered a new financial product for NAB customers and filled a strategic gap in NAB’s service offering.

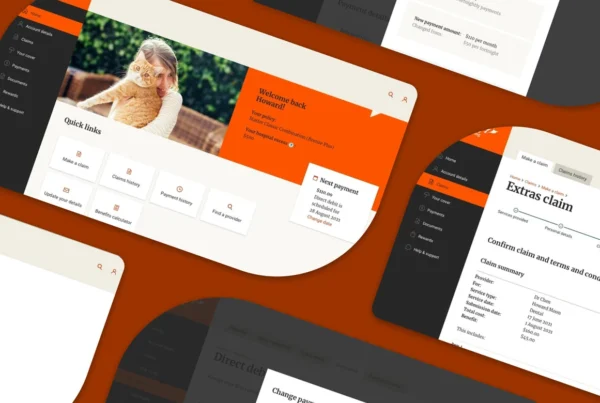

NAB Now Pay Later offers customers Buy Now Pay Later (BNPL) cost splitting using familiar payment mechanisms. Accepted on any terminal or online checkout, customers can use their NAB Now Pay Later digital card like any other, confident that the purchase will be split into four predictable and automated repayments.

For the bank, NAB Now Pay Later is one of the first banks globally to offer a BNPL proposition to meet the needs of younger and credit-averse customers. NAB Now Pay Later fills a gap in NAB’s service offering, strengthening their banking relationship with customers as their financial needs progress to higher margin lending products.

Process

This project followed a double-diamond design process, using iterative methods to explore and refine the product. In the early stages, Symplicit conducted expert interviews, evaluated competitors, analysed industry-level quantitative studies, and conducted qualitative customer interviews. This research built a picture of what a successful product would look like for NAB. The team used these findings to evaluate several partnering opportunities as unsuitable before exploring what a NAB-built product would look like and how it could work within the NAB regulatory and technology environments.

As the product strategy took shape, Symplicit built out the experience, collaborating with tech partners and conducting customer testing to inform and refine an experience which was viable for the bank and desirable for customers.

With the experience mapped out and validated with users, the project moved into the second diamond of the design process; the focus shifted to refining and delivering the product. At this point several designers joined the team, helping refine experience details, creating detailed UI, and collaborated with the accessibility and delivery teams to QA the delivered product. The team worked across multiple digital platforms delivering intuitive integration into the NAB mobile app, internet banking, and banker platforms. Alongside the core experience the team built out the end-to-end service, crafting a streamlined in-channel application, supporting change efforts with service teams, and helping shape business processes which support the product.

As the development shifted into a higher gear, the team focused on rounding out the end-to-end experience, creating digitally integrated customer-friendly terms and conditions, polishing the notification strategy and content, and collaborating with the brand and marketing teams on product launch activities.

Mindset

Throughout the project the team worked with a deeply collaborative spirit, bringing together team members, and connecting with stakeholders across the bank to ensure a successful result that everyone was confident in. Across all design contributions the team was customer-centric and committed to a quality design process, consistently advocating for a simple, transparent experience which customers could intuitively use and understand.