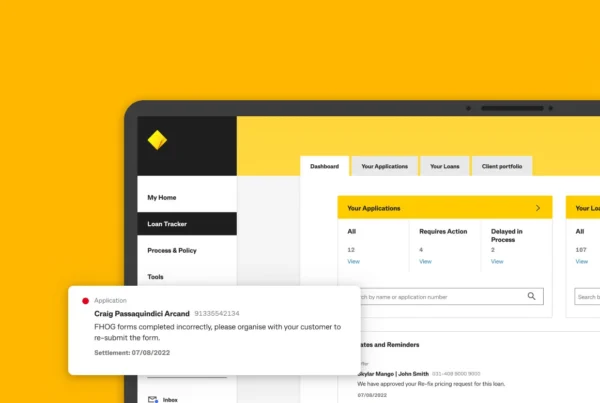

Finance broker portal redesign

Client

Commonwealth Bank of Australia

Services

User research, data & analytics, product strategy, usability testing, product design, agile

Industry

Financial Services

Year

2021 – 2022

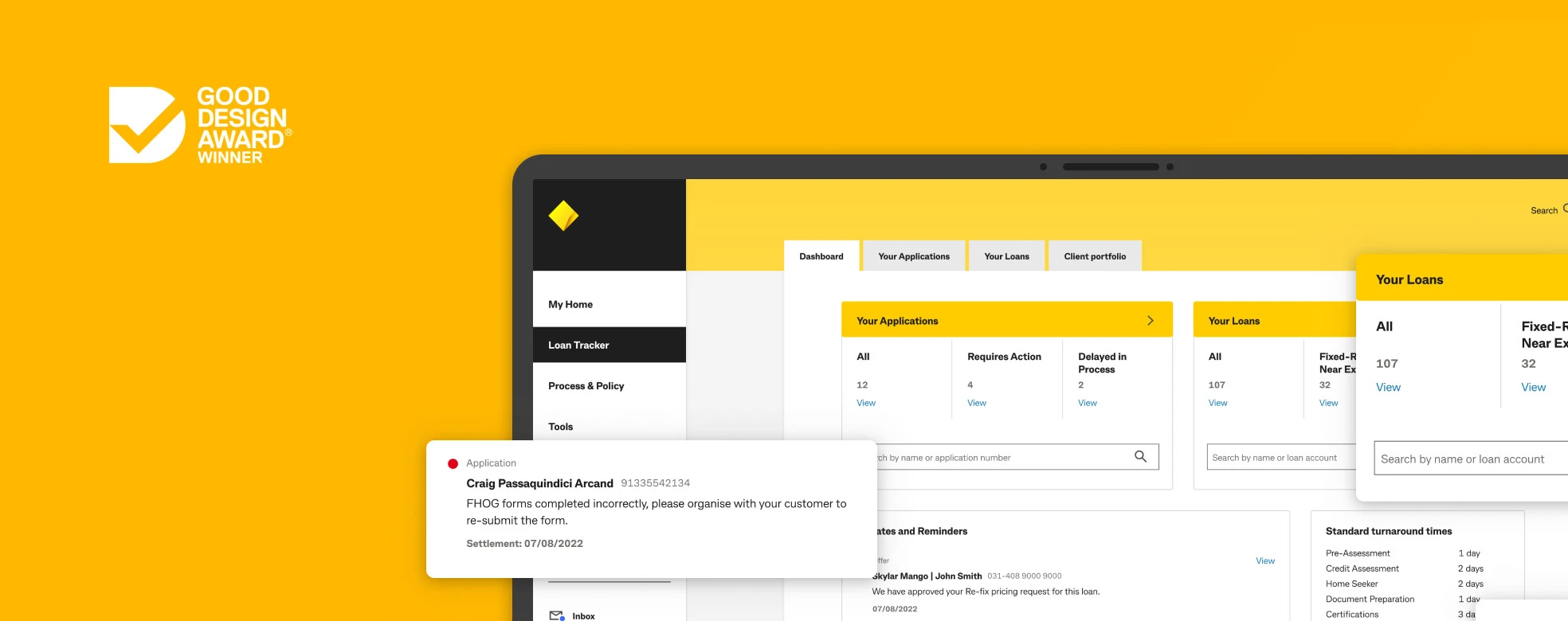

“The New Broker Portal for CommBank is empowered by a strong design system. From logical interfaces to graceful content groupings, this is an interactive project that offers a direct benefit to its users.”

– Good Design Jury

Background

Commonwealth Bank of Australia’s (CommBank) residential loan book services 1.2 million customers and contributes AUD638 billion in annual revenue. In 2023, broker funded loans accounted for 71% of home lending, however, historical market conditions meant the digital broker platform has seen low investment, leading to a deterioration of user experience and performance. CommBank’s digital product team sought to mitigate this risk and create the country’s #1 digital broker proposition.

Approach

This engagement was delivered over two phases, discovery (1) and delivery (2). Mixed-methods research guided decision making during the discovery phase. Our approach entailed qualitative activities including 1:1 broker interviews, heuristic evaluation and landscape review, card sorting, prototyping, and moderated user testing. Quantitative activities included analysis of data & analytics and call centre logs, top task analysis, tree testing and UEQ (User Experience Questionnaire) benchmarking.

The first phase (8-weeks in duration) enabled validation of key assumptions, establishment of an intuitive information architecture (IA), and informed the roadmap and product goals for the first release, which included:

- Introduce self-serve functionality for key tasks.

- Improve discoverability of key features.

- Design more intuitive interactions and reduce the time to complete tasks.

The delivery phase (18-months duration) entailed detailed design and development. This phase was a collaboration between Symplicit, HCLTech and CommBank, who formed cross-functional agile teams responsible for designing and delivering features.

To enable multiple squads to work in tandem, Symplicit and CommBank established a design system. The design system evolved throughout the duration of the engagement to meet the complex nature of the tasks the system needed to fulfil. To ensure the redesign was easy to learn and use, we conducted ongoing user testing, this enabled design iteration to take place and avoidance of technical debt.

Impact

Broker portal engagement sky-rocketed post-launch, with a 50% increase in monthly active users. The re-designed experience achieved a top rating in user satisfaction from 90% of users surveyed, call centre volumes reduced by 350 calls per day (resulting in AUD 1.5 million in annual savings), and time to access critical loan information reduced from 15-minutes down to mere seconds.

Overall, brokers have attained efficiency gains of up to 20-hours of time saved per week. Importantly, brokers have communicated that the new platform has reduced stress for their customers – as of May 2023 (release 1), >90% of balances have been retained.